IDEX network

First, let’s start with a basic explanation of what IDEX represents. This is a decentralized exchange for those willing to trade Ethereum assets. The news here is that AURA staking nodes are going to back it up. What does this mean? Node operators are going to gain staking rewards for their contribution in the securing process of the Aurora network. The reward’s origin is relied on fees, collected from the AURA network, which are about to be proportional to the staking percentage of nodes.

AURA token

Pretty similar to other tokens, AURA is gaining its value from the market, but unlike them – it’s used extensively. This led to exceeding the market cap of the token on a daily basis volume, facilitated by the exchange. Here comes the IDEX’s role. Ranked as one of the top Dapps in the ETH network, which is certainly gaining popularity, IDEX is going to be involved in the Aurora network. How? Well, the distribution fees, paid on the IDEX platform, will be split in a half in order to support the AURA staking nodes. It is planned to increase the percentage to 100, which will transform Aurora in a community-driven platform. The distribution is going to automatically grant higher transparency.

Action plan

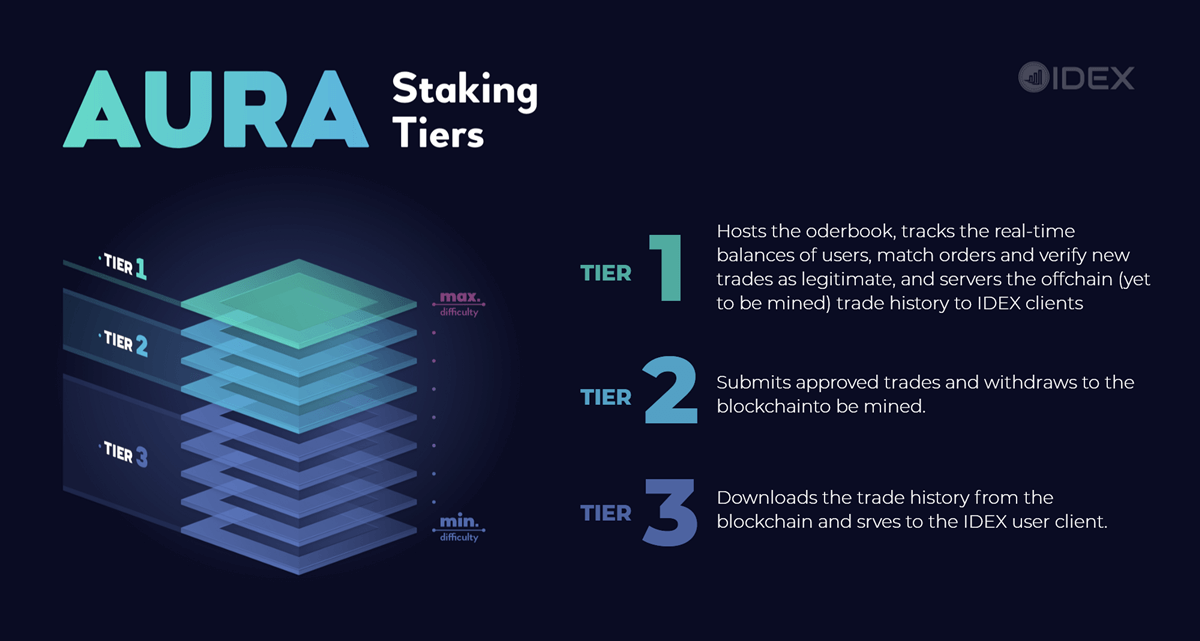

Started wondering how it will look like? Let us paint you the picture: the AURA staking nodes will be separated into three groups. Each of them is about to possess unique functionalities in the IDEX network. There’s already a planned order of releasement for every group. Starting with ‘Tier 3’, the network will lately launch ‘Tier 2’ and finally ‘Tier 1’. Want to know some more? Check this out:

Tier 3 – Trade History

These nodes are going to possess all the IDEX history. They will offer the IDEX users that information and will finally be rewarded for their contribution.

Tier 2 – Transaction Arbiter

Here, we observe the core of the process. In a word, this is the relation between the arbiter node and the validator one. When a stakeholder deposit AURA tokens in a staking contract, this will whitelist the node of known submitting addresses. After it, a new address will be generated to become a transaction arbiter for the particular list. The last-mentioned node will create and sign transactions, which are going to be verified by another staking node, picked from the whitelist once again. This second one is simply a validator, who will sign and submit the transaction to the blockchain.

Tier 1 – Distributed Orderbook

The lastly-planned to release group will consist of stakers, who are required to run a Masternode, accommodating several requirements. This includes orderbook, real-time tracking of the users’ balance, matching orders, verifying sign transactions before they are sent to the arbiter. Here it will be the highest minimum token requirement to lock in order to operate. That’s why it’s expected to offer the highest payout from all the three Tiers.

Bottom line

Ultimately, the alpha version of the AURA staking software is more likely to arrive in the last quarter of this year, which will allow the node operator to finally run the planned ‘Tier 3’.

There’s a planned reward for it, about 25% of IDEX’s trading fees or proportionally calculated in Ethers. The minimum amount to lock for your Masternode is going to be 10 000 AURAs.

If it all works as planned, the reward is planned to increase to 33% for ‘Tier 2’ and 42% at the final ‘Tier 1’ stage. Of course, changes are going to be implemented in regular time intervals, so all the network’s users would be able to adapt their staking process.